Creating new value in a

“world with positive interest rates”

Together with our clients.

We would like to express our sincere gratitude for your continued support and patronage.

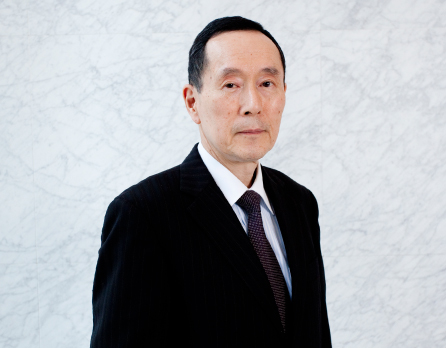

In February 2026, I assumed the position of President. It is a profound honor, and a sobering responsibility, to take the helm of this institution—one that has served as a cornerstone of Japan’s money market infrastructure for over 110 years.

Currently, Japan’s finacial environment is at a major turning point. Following gradual rate hikes since 2024, policy rates have reached levels not seen in 31 years, and a “world with positive interest rates” has become firmly established. As this upward trend is expected to continue through 2026, the challenges facing market participants are becoming increasingly complex. Consequently, I believe the role required of us as a money market broker, and the expectations placed upon us by our clients, will be greater than ever before.

In response to this shifting environment, we have launched our new Medium-Term Management Plan this term. Under this plan, we have defined our mission as “providing the highest quality solutions to our clients’ challenges.” By leveraging the collective strengths of our group companies, we aim to offer high-value-added solutions that go beyond conventional brokerage—not only in the money markets but also in the foreign exchange, bond, derivatives, and private equity (PE) markets. Furthermore, we are committed to reinforcing our operational resilience as a financial infrastructure provider—such as enhancing our Business Continuity Planning (BCP) through our Osaka Branch—to ensure we deliver “unwavering peace of mind at all times.”

In this era of transformation, we will never lose sight of our core principle: “Walking together with our clients.” Our entire team is dedicated to working with sincerity and integrity, striving to remain a reliable compass for all our stakeholders.

We look forward to your continued support and guidance.

- February, 2026

- President

Toshiaki Terada